29 minutes

(Read 92) Thinking Fast and Slow

Release year: 2011

Author: Daniel Kahneman

Review

In this book, Daniel Kahneman invites us to explore our innate biases and proceeds to show us why, statistically, we tend to get things wrong. The author’s mission is to improve our watercooler conversations so that, as a group and as individuals, we make better decisions. His thesis is that using a richer and more precise language to identify and understand errors of judgement and choice will improve our comprehension of various situations.

When put this way, it sounds straightforward. But the path that Kahneman had to follow to reach his conclusions led him to receive a Nobel prize ten years before this book was published. The rich language required to precisely discuss neuroeconomics is similar to medical speech, where one single word in a diagnostic is actually a suitcase of information. As I turned the final page, it seemed obvious to me that the wisdom contained within these pages were the output of a life spent thinking about reconciling intuition with statistics.

Then again, I might be saying this because my System 1 got fooled by the anchor effect of seeing a quote on the front cover that qualifies this book as a masterpiece and “one of the greatest and most engaging collections of insights into the human mind.” 😄

Kahnemen knows that it is impractical to base every decision on statistics alone, without listening to our intuition. Making good, evidence-based decisions is quite the balancing act. What I find remarkable is that by providing a multitude of examples from his research, he is often able to put a number on how much our bad decisions are costing us. Here’s an example, taken from the book (p. 280):

Situation 1: In addition to whatever you own, you have been given $1,000. You are now asked to choose one of these options:

- A: 50% chance to get an extra $1,000

- B: 100% chance to get an extra $500

Situation 2: In addition to whatever you own, you have been given $2,000. You are now asked to choose one of these options:

- C: 50% chance to lose $1,000

- D: 100% chance to lose $500

If you’re like most people studied by Kahneman, your choices would be respectively B and C. What’s interesting here is that both problems offer the certainty of being richer than you already are by $1,500, but somehow we tend to start gambling when our reference point is higher. This example illustrates the concept of “practical utility.”

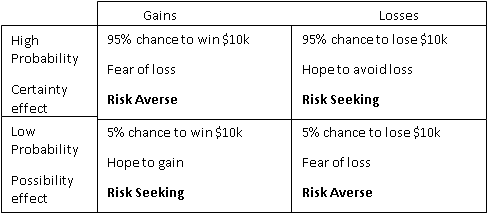

People are loss averse, which has many interesting consequences. This explains why some people will accept bad deals with their insurer (paying a too high premium for a too low payout), or why some people will become risk seeking when are surrounded by bad options. In fact, all of these behaviors and more can be summarized by the Fourfold Pattern of Prospect Theory, seen below.

The upper-right quadrant is the most fascinating one. This is where people, surrounded by bad options, choose to take a gamble at the risk of creating an even worse disaster. This is where we often struggle to accept the loss and keep fighting beyond what would be economically reasonable.

There is so much more depth to this book. I haven’t even mentioned Systems 1 and 2 yet, which are the main “characters” of the story. System 1 is the fast, reactive part of our brain, that is constantly scanning our senses to pick up and react on stimuli. System 2 is the slow, methodical system that gets called in when System 1 can’t handle the load. Most times, System 2 simply rubber stamps the conclusions drawn by System 1. Kahneman tells us to pay attention to this dynamic, so that we don’t gamble on a story simply because it is coherent (which is what System 1 excels at creating).

To summarize, Thinking Fast and Slow is a triumphant marriage of psychology and economics, also known as neuroeconomics. I am convinced that your decision-making could improve from learning about the concepts taught in this book:

- cognitive ease

- regression to the mean

- question substitution

- anchors

- cognitive illusions

- the outside view

- the endowment effect

- risk policies

- life as a story

- …

There is a lot of material contained in these 400 pages. If you’re willing to put your mind to the test, this is an easy recommendation!

Félix rating:

👍👍

👍👍

Keywords

- intuition

- anchor

- regret

- confidence

- bias

- skill

- memory

- information

- risk

- losses

- judgements

- ignorance

- evidence

- effort

- decisions

- beliefs

⭐ Star Quotes

Introduction

- (p. 3) ⭐ It is much easier, as well as far more enjoyable, to identify and label the #mistakes of others than to recognize our own.

- (p. 6) #boredom — It is much easier to strive for #perfection when you are never bored.

- (p. 9) ⭐ #Luck plays a large role in every story of #success.

- (p. 11) #Intuition is recognition.

- (p. 12) When faced with a difficult question, we often answer an

easier one instead, without noticing the substitution:

- Should I invest in Ford Stock?…

- … becomes: Do I like Ford cars?

Part 1: Two Systems

Chapter 1: The Characters of the Story

- (p. 23) You dispose of a limited #budget of #attention.

- (p. 23) You can do several things at once, but only if they are easy and undemanding.

- (p. 24) ⭐ We can be blind to the #obvious, and we are also blind to our #blindness.

- (p. 24) If endorsed by System 2, #impressions and #intuitions turn into #beliefs, and #impulses turn into voluntary #actions.

- (p. 28) A strong #attraction to a patient with a repeated history of failed treatment is a #danger sign. It is a #cognitive-illusion.

Chapter 2: Attention and Effort

- (p. 35) ⭐ In the #economy of action, #effort is a #cost, and the acquisition of #skill is driven by a cost-benefit balance.

- (p. 36) ⭐ #Effort is required to maintain simultaneously in #memory several ideas that require separate actions, or that need to be combined according to a rule.

Chapter 3: The Lazy Controller

- (p. 45) ⭐ When people believe a #conclusion is #true, they are also very likely to believe #arguments that appear to support it, even when these arguments are unsound.

- (p. 46) ⭐ #Intelligence = #Reasoning Ability + #Memory + Controlled #Focus

- (p. 49) ⭐ High #intelligence does not make people immune to #biases.

Chapter 4: The Associative Machine

- (p. 54) ⭐ Reciprocal #priming effects (e.g. thinking “health” -> exercising -> thinking “health” -> …) produce a #coherent #action.

- (p. 55, 56) ⭐ The #idea of #money primes #individualism

- (p. 56) Reminding people of their mortality increases the appeal of #authoritarian ideas, which may become reassuring in the context of the terror of #death

Chapter 5: Cognitive Ease

- (p. 60) The causes and consequences of #cognitive-ease:

- Repeated experience

- Clear display

- Primed idea

- Good mood ⬇️

- Cognitive ease ⬇️

- Feels familiar

- Feels true

- Feels effortless

- Feels good

- Cognitive ease ⬇️

- (p. 60) In a state of #cognitive-ease, you are more likely to be

relatively casual and superficial in your #thinking. In a state of

#cognitive-strain, you are more likely to be:

- vigilant and suspicious

- investing more effort in what you are doing

- feeling less comfortable

- making fewer errors

- less intuitive and creative

- (p. 62) Anything that makes it easier for the associative machine to run smoothly will also #bias beliefs.

- (p. 62) #Simplicity is perceived as #familiarity, which is perceived as #truth.

- (p. 63) ⭐ To be perceived as #credible and #intelligent, do not use complex language where a simple language will do.

- (p. 64) The recipients of your #message want to stay away from anything that reminds them of #effort.

- (p. 67) The exposure effect occurs because the repeated exposure to a stimulus is followed by nothing bad. Such a stimulus will eventually become a #safety signal, and safety is good.

- (p. 67) ⭐ #Creativity is associative memory that works exceptionally well.

- (p. 69) ⭐ #Mood affects the operation of System 1: When we are uncomfortable and unhappy, we lose touch with out #intuition.

- (p. 70) “I’m in a very good mood today, and my System 2 is weaker than usual. I should be extra careful.”

Chapter 6: Norms, Surprises and Causes

- (p. 75) ✅ A statement that can #explain two contradictory outcomes explains nothing at all.

- (p. 77) ⭐ Two central #beliefs of many #religions:

- An immaterial divinity is the ultimate cause of the physical world.

- Immortal souls temporarily control our bodies while we live and leave them behind as we die.

- (p. 77) The foundation of nearly all #religions is our instinctive separation between physical and intentional #causality.

- (p. 78) When we can’t accept bad luck, we blame it on an external intention.

- (p. 83) How to grade an #exam with #bias: Read and score all the students’ answers to the first question, then go on to the next one. Make sure to write all the scores on the inside back page of the booklet so that you can’t be biased.

- (p. 83) The #halo-effect is our tendency to like (or dislike) everything about something or someone. It is a lack of #nuance.

- (p. 85) ✅ Eliminating redundancy from your sources of #information is always a good idea.

- (p. 85) Before a group #discussion, individually summarize your opinion by writing it down. Make sure all are heard. This makes good use of the value of the #diversity of knowledge and opinion in the group.

- (p. 85) The standard practice of open #discussion gives too much weight to the opinions of those who speak early and assertively, causing others to line up behind them.

- (p. 85) WYSIATI: What you see is all there is.

- (p. 85) The measure of success for System 1 is the coherence of the story it manages to create.

- (p. 86) ⭐ To activate System 2, start by asking “What would I need to know before I formed an #opinion about XYZ?”

- (p. 86) System 1 is expected to influence even the more careful #decisions. Its input never ceases.

- (p. 87) For a good #story, what matters is consistency, not completeness.

- (p. 87) ⭐ Knowing little makes it easier to fit everything you know into a #coherent pattern.

Chapter 8: How Judgements Happen

- (p. 90) We are endowed with an ability to evaluate,

in a single glance at a stranger’s face, two potentially

crucial facts:

- How dominant (and therefore potentially threatening) he is

- How trustworthy he is (are his intentions friendly or hostile?)

- (p. 90) The ability of face reading is far from perfect.

- (p. 91) ⭐ People judge #competence by combining the two dimensions of #strength and #trustworthiness.

Chapter 9: Answering an Easier Question

- (p. 98) ⭐ If you can’t solve a #problem, then there is an easier problem you can solve: find it.

- (p. 103) Present #state-of-mind is an #anchor when people evaluate their average #happiness over past days.

- (p. 103) Smaller risks make benefits look more enticing.

Part 2: Heuristics and Biases

Chapter 10: The Law of Small Numbers

- (p. 110) Paradox: A #random event, by definition, does not lend itself to explanation, but collections of random events do behave in a highly regular fashion.

- (p. 111) Small #samples yield extreme results more often than large samples do.

- (p. 117) ⭐ We are far too willing to reject the belief that much of what we see in life is random.

- (p. 118)First check the reliability of a message before assessing the information.

- (p. 118) ⭐ Causal explanations of chance events are inevitably wrong.

Chapter 11: Anchors

- (p. 119) Anchoring effect: When people consider a particular value for an unknown quantity before estimating that quantity. The #estimates stay close to the number that people considered (the “#anchor”).

- (p. 120) Anchor-and-adjust is a strategy for estimating

uncertain quantities:

- Start from an anchoring number.

- Assess whether it is too high or too low.

- Gradually adjust your estimate by mentally “moving” from the #anchor.

- (p. 121) Responses to anchors:

- People who shake their head move farther from the #anchor.

- People who nod their head show enhanced anchoring.

- (p. 121) People stay closer to the #anchor when their mental resources are depleted.

- (p. 126) Don’t negotiate with an outrageous offer on the table. Do make a scene, threaten to storm out (or do so), make it clear to everyone (and yourself) that you will not continue the #negotiation with that number on the table.

- (p. 127) To find arguments against an #anchor,

- Focus on the minimal offer that the opponent would accept.

- ⭐ Focus on the costs to the opponent of failing to reach an #agreement.

Chapter 12: The Science of Availability

- (p. 132) ⭐ #Self-ratings are dominated by the ease with which examples come to mind.

- (p. 133) ⭐ ⭐ The proof that you truly understand a pattern of #behavior is that you know how to reverse it.

- (p. 134) Ease of retrieval of #information is itself used as information, except when it seems assisted by an external factor (e.g. “Mozart music helps the memory”)

- (p. 135) Merely reminding people of a time when they had #power increases their apparent #trust in their own #intuition.

Chapter 13: Availability, Emotion, and Risk

- (p. 138) ⭐ Our expectations about the frequency of events are distorted by the prevalence and emotional intensity of the messages to which are are exposed.

- (p. 140) ⭐ When experts and the public #disagree on their priorities, each side must respect the insights and intelligence of the other.

- (p. 141) The evaluation of #risk depends on the choice of a

#measure — with the obvious possibility that the choice may have

been guided by a preference for one outcome or another.

- Defining risk is thus an exercise in #power.

- (p. 142) The #importance of an idea is often judged by the fluency (and emotional charge) with which that idea comes to mind.

- (p. 144) #Terrorism speaks directly to System 1.

- (p. 144) Rational or not, #fear is painful and debilitating, and policy makers must endeavour to protect the public from fear, not only from real #dangers.

Chapter 14: Tom W’s Specialty

- (p. 153) There are two possible reasons for the #failure of System 2 — #ignorance or #laziness.

- (p. 153) Unless you decide immediately to reject #evidence, your System 1 will automatically process the information available as if it were true.

- (p. 153) When you have doubts about the quality of the evidence, let your judgements of probability stay close to the base rate.

Chapter 15: Linda: Less Is More

- (p. 158) #Fallacy: When people fail to apply a logical rule that is obviously relevant.

- (p. 159) ⭐ The following notions are easily confused by the

public:

- Coherence: Internal consistency of an argument, where all parts logically fit together

- Plausibility: The degree to which something seems believable based on current knowledge

- Probability: A measure of likelihood that a specific event will occur, expressed by a percentage or fraction

- (p. 160) ⭐ A trap for forecasters and their clients is that adding details to #scenarios makes them more #persuasive, but also less likely to come true.

- (p. 165) Lawyer tactics:

- To demolish a case, raise #doubts about the strongest arguments that favor it

- To discredit a witness, focus on the weakest part of the testimony

Chapter 16: Causes Trump Statistics

- (p. 169) #Stereotypes, both correct and false, are how we think of categories.

- (p. 172) ⭐ Changing one’s mind about human nature is hard work, and changing one’s mind for the worse about oneself is even harder.

- (p. 173) People quietly exempt themselves (and their friends, acquaintances) from the conclusions of experiments that surprise them.

- (p. 174) When presented with a surprising statistical fact,

students manage to learn nothing at all. When surprised by

individual cases, students tend to more easily make the correct

generalization.

- “Subjects’ unwillingness to deduce the particular from the general was matched only by their willingness to infer the general from the particular.”

- (p. 174) ⭐ The test of learning #psychology is whether your understanding of situations you encounter has changed, not whether you have learned a new fact.

- (p. 174) Surprising individual cases have a powerful impact and are a more effective tool for #teaching psychology because the incongruity must be resolved and embedded in a causal story.

- (p. 174) ⭐ You are more likely to #learn something by finding surprises in your own #behavior than by hearing surprising facts about people in general.

Chapter 17 Regression to the Mean

- (p. 174) #Rewards for improved performance work better than #punishment of mistakes.

- (p. 176) #Regression-to-the-mean statistically punishes for being nice and rewards for being nasty.

- (p. 177)

- Success = Talent + Luck

- Great Success = A little more talent + A lot of luck

- (p. 178) ⭐ #Regression-to-the-mean does not have a causal explanation. It is #statistics.

- (p. 181) ⭐ Uncorrelated scores will #regress-to-the-mean.

Chapter 18: Taming Intuitive Predictions

- (p. 187) Intensity matching after a substitution yields #predictions that are as extreme as the evidence on which they are based.

- (p. 192) Correcting your #intuitions may complicate your life.

- (p. 192) Unbiased predictions permit the #prediction of #rare or extreme events only when the #information is very good.

- (p. 192) Absence of #bias is not always what matters most.

- (p. 193) If you choose to delude yourself by accepting extreme #predictions, you must remain aware of your #self-indulgence.

- (p. 194) It is natural for System 1 to generate overconfident #judgements, because #confidence is determined by the #coherence of the best story you can tell from the #evidence at hand.

Part 3: Overconfidence

Chapter 19: The Illusion of Understanding

- (p. 199) ⭐ The explanatory #stories that people find

compelling:

- are simple

- are concrete rather than abstract

- assign a larger role to talent, stupidity and intention than to luck

- focus on a few striking events that happened rather than on the countless events that failed to happen.

- (p. 200) ✅ ⭐ The ultimate test of an #explanation is whether it would have made the event #predictable in advance.

- (p. 201) ⭐ The more #luck was involved, the less there is to be #learned.

- (p. 201) ⭐ Our comforting conviction that the world makes sense rests on a secure foundation: our almost unlimited ability to ignore our #ignorance.

- (p. 202) ⭐ To think clearly about the future and avoid

#hindsight-bias, we need to clean up the language that we use in

labeling the beliefs we had in the past:

- ❌ “I knew that all along”

- ❌ “Premonition”

- ❌ “Intuition”

- (p. 202) A general limitation of the human mind is its imperfect ability to reconstruct past states of knowledge, or beliefs that have changed.

- (p. 202) A general limitation of the human #mind is its imperfect ability to reconstruct past states of #knowledge, or #beliefs that have changed.

- (p. 203) #Hindsight bias leads observers to assess the quality of a #decision not by whether the process was sound but by whether its outcome was good or bad.

- (p. 203) Actions that seemed prudent in foresight can look irresponsibly negligent in #hindsight.

- (p. 204) The worse the consequence, the greater the #hindsight #bias.

- (p. 204) Decision makers who expect to have their decisions scrutinized with hindsight are drive to #bureaucratic solutions and to an extreme reluctance to take #risks.

- (p. 206) #Stories of success and failure consistently exaggerate the impact of leadership style and management practices on firm outcomes, and thus their message is rarely useful.

- (p. 206) Because of the halo effect, we get the causal relationship backward: we are prone to believe that the firm fails because its CEO is rigid, when the truth is that the CEO appears to be rigid because the firm is failing. This is how illusions of understanding are born.

- (p. 207) ⭐ In the presence of #randomness, regular #patterns can only be mirages.

Chapter 20: The Illusion of Validity

- (p. 209) The subjective #confidence we have in our #opinions reflects the #coherence of the story that Systems 1 & 2 have constructed.

- (p. 209) The amount of #evidence and its quality do not count for much because poor evidence can make a very good story.

- (p. 212) Declarations of high #confidence mainly tell you that an individual has constructed a coherent #story in their mind, not necessarily that the story is true

- (p. 217) ⭐ People can maintain an unshakable faith in any proposition, however absurd, when they are sustained by a community of like-minded #believers. For example, trust fund managers in the financial community.

- (p. 218) The illusion that we understand the #past fosters #overconfidence in our ability to #predict the future.

- (p. 219) Acquiring #knowledge develops an enhanced illusion of #skill and generates unrealistic #overconfidence.

- (p. 219) The more #famous the forecaster, the more flamboyant the #forecasts.

- (p. 219) #Experts are led astray not by what the believe but by how they think.

Chapter 21: Intuitions vs. Formulas

- (p. 224) Several studies have shown that human #decision makers are inferior to a prediction formula even when they are given the score suggested by the formula!

- (p. 225) ⭐ To maximize predictive accuracy, final decisions

should be left to formulas, especially in low-validity

environments.

- Low-validity environments: Domains that entail a significant degree of uncertainty and unpredictability.

- (p. 226) Marital stability is well predicted by the formula:

- (Frequency of lovemaking) - (Frequency of quarrels)

- You don’t want the result to be a negative number.

- (p. 226) An #algorithm constructed on the back of an envelope is often good enough to compete with an optimally weighted formula, and certainly good enough to outdo #expert #judgement.

- (p. 229) ⭐ It is unethical to rely on intuitive judgements for important #decisions if an algorithm is available that will make fewer mistakes.

- (p. 229) For most people, the #cause of a #mistake matters. The difference in emotional intensity is readily translated into a moral preference.

- (p. 232) #Intuition adds value only after a disciplined collection of objective information and disciplined scoring of separate traits.

- (p. 232) ⭐ Do not simply trust intuitive judgements, but do not dismiss it, either.

- (p. 232) ⭐ A #hiring #algorithm:

- Select a few traits that are prerequisites for success in this position (technical proficiency, engaging personality, reliability, …). Six dimensions is a good number, should be independent.

- Assess the dimensions by asking factual questions. Make a list of those questions for each trait and score them 1-5. Know in advance what is “very weak” and “very strong.”

- For each candidate, add up the six scores. Firmly resolve that you will hire the candidate whose final score is the highest, even if there is another whom you like better.

Chapter 22: Expert Intuition: When Can We Trust It?

- (p. 238) Learned #fears are more easily acquired than learned #hope.

- (p. 238) #Expertise in a domain is not a single #skill but rather a large collection of miniskills.

- (p. 240) The #confidence that people have in their #intuition is not a reliable guide to their validity. Do not trust anyone —including yourself— to tell you how much you should trust their judgement.

- (p. 240) ⭐ #Judgements and #intuition reflect #expertise and

#skill when:

- an environment is sufficiently regular to be predictable

- there is an opportunity to learn these regularities through prolonged practice

- (p. 241) Statistical #algorithms greatly outdo humans in noisy

environments because:

- they are more likely than human judges to detect weakly valid cues

- they are much more likely to maintain a modest level of accuracy by using such cues consistently.

- (p. 241) #Intuition cannot be trusted in the absence of stable regularities in the environment.

- (p. 241) #Intuition = (Quality & Speed of #Feedback) + #Practice

- (p. 242) Short-term #anticipation and long-term #forecasting are

different tasks.

- The therapist has had adequate opportunity to learn one but not the other.

- (p. 243) #Judgements that answer the wrong question can also be made with high #confidence.

Chapter 23: The Outside View

- (p. 248) #Unknown unknowns: Succession of events that would

cause a project to drag out:

- divorces

- illness

- crises of coordination with bureaucracies

- …

- (p. 249) People who have information about an individual case rarely feel the need to know the statistics of the class to which the case belongs. This is a #bias that leads to mistakes.

- (p. 250) The authors of unrealistic #plans are often driven by the desire to get the plan approved

- (p. 251) ⭐ The greatest responsibility for avoiding the

planning fallacy lies with the decision makers who approve the

#plan.

- Planning #fallacy: Plans and forecasts that

- are unrealistically close to best-case scenarios

- could be improved by consulting the stats of similar cases

- Planning #fallacy: Plans and forecasts that

- (p. 252) A #budget reserve is to contractors what red meat is to lions; they will devour it.

- (p. 252) A well-run organization will #reward planners for precise execution and #penalize for failing to anticipate difficulties and for failing to allow for #unknown unknowns

- (p. 254) ⭐ The outside view is to forget about one’s own case and look for what happened in other cases. It is never natural to look for the outside view.

Chapter 24: The Engine of Capitalism

- (p. 257) Generally, the financial benefits of #self-employment are mediocre: given the same qualifications, people achieve higher average returns by selling their skills to employers than by setting out on their own.

- (p. 262) #Optimism is highly valued, socially and in the market; people and firms reward the providers of dangerously misleading information more than they reward truth tellers.

- (p. 263) #Experts who acknowledge the full extent of their #ignorance may expect to be replaced by mere confident competitors, who are better able to gain the #trust of clients.

- (p. 263) ⭐ An unbiased appreciation of #uncertainty is a cornerstone of #rationality, but extreme uncertainty is paralyzing under dangerous circumstances. The admission that one is merely guessing is especially unacceptable when the #stakes are high.

- (p. 264) Premortem: When the organization has almost come to an

important decision but has not formally committed itself, gather

for a brief session a group of individuals who are knowledgeable

about the decision. The main virtue of the premortem is that it

legitimizes doubts.

- “Imagine that we are a year into the future. We implemented the plan as it now exists. The outcome was a disaster. Please take 5 to 10 minutes to write a brief history of that disaster.”

Part 4: Choices

Chapter 25: Bernouilli’s Errors

- (p. 273) The psychological value of a #gamble is not the weighted average of its possible dollar outcomes; it is the average of the utilities of these outcomes, each weighted by its probability.

- (p. 274) ⭐ A decision maker with diminishing marginal utility for #wealth will be risk averse.

- (p. 274) The poorer man will happily pay a premium price to transfer the #risk to the richer one. That’s essentially what insurance is.

- (p. 277) Theory-induced blindness: Once you have accepted a theory and used it as a tool in your thinking, it is extraordinarily difficult to notice its flaws.

Chapter 26: Prospect Theory

- (p. 279) ⭐ You know you have made a theoretical advance when you can no longer reconstruct why you failed for so long to see the obvious.

- (p. 280) People become risk seeking when all their options are bad.

- (p. 284) #Losses loom larger than #gains.

Chapter 27: The Endowment Effect

- (p. 292) #Tastes are not fixed; because of loss #aversion, they vary with the reference point.

- (p. 298) To eliminate the Endowment Effect, ask “How much do I want to have that thing compared with other things I could have instead?”

- (p. 299) “She didn’t care which of the two offices she would get, but a day after the announcement was made, she was no longer willing to trade. Endowment Effect!”

- (p. 302) ⭐ The long-term success of a #relationship depends far more on avoiding the negative than on seeking the positive.

- (p. 304) Many of the messages that negotiators exchange in the course of #bargaining are attempts to communicate a reference point and provide an #anchor to the other side. The messages are not always sincere.

- (p. 305) Animals, including people, fight harder to prevent #losses than to achieve #gains. In the world of territorial animals, this principle explains the success of defenders.

- (p. 306) ⭐ A basic rule of #fairness is that exploitation of

market power to impose losses on others is unacceptable.

- (p. 308) Employers who violate rules of fairness are punished by reduced productivity, and unfair merchants lose sales.

- (p. 308) ⭐ Maintaining the social order and the rules of fairness is its own #reward.

Chapter 29: The Fourfold Pattern

- (p. 317,318,319) ⭐

- (p. 320) In the face-off between a risk-averse plaintiff and a risk-seeking defendant, the defendant holds the stronger hand.

- (p. 321) Paying a premium to avoid a small #risk of a large #loss is costly.

Chapter 30: Rare Events

- (p. 325) The probability of a rare event is most likely to be overestimated when the alternative is not fully specified.

- (p. 328) A vivid representation of an outcome messes up our ability to calculate probabilities.

- (p. 329) Denominator neglect: Low-probability events are much more heavily weighted when described in terms of relative frequencies (how many) than when stated in more abstract terms of “chances”, “risk”, or “probability” (how likely)

- (p. 333) A #rare event will be overweighted if it specifically attracts attention.

Chapter 31: Risk Policies

- (p. 335) ⭐ It is costly to be risk averse for gains and risk seeking for losses.

- (p. 340) ⭐ Example of risk policies are “always take the highest possible deductible when purchasing insurance,” and “never buy extended warranties.”

Chapter 32: Keeping Score

- (p. 345) Driving into a blizzard because you paid for show tickets is a sunk-cost error.

- (p. 346) Boards of directors often replace a CEO who is encumbered by prior decisions and reluctant to cut losses.

- (p. 346) #Regret is accompanied by:

- feelings that one should have known better

- a sinking feeling

- thoughts about the mistake one has made and the opportunities lost

- a tendency to kick oneself and to correct one’s mistake

- wanting to undo the event and to get a second chance

- (p. 346) Intense #regret is what you experience when you can most easily imagine yourself doing something other than what you did.

- (p. 348) People expect to have stronger emotional reactions (including regret) to an #outcome that is produced by action than to the same outcome when it is produced by inaction.

- (p. 348) ⭐ It is the departure from the #default that produces #regret.

- (p. 351) “The intense #aversion to trading increased risk for some other advantage may be motivated by a selfish fear of regret more than by a wish to optimize a situation.”

- (p. 352) ⭐ If you can remember when things go badly that you considered the possibility of #regret carefully before deciding, you are likely to experience less of it.

- (p. 352) People generally anticipate more #regret than they will actually experience, because they underestimate the efficacy of the psychological defenses they will deploy (psychological immune system).

- (p. 352) ⭐ You should not put too much weight on #regret; even if you have some, it will hurt less than you now think.

Chapter 34: Frames and Reality

- (p. 364) ⭐ #Costs are not #losses.

- (p. 367) #framing — System 1 is rarely indifferent to emotional words: “90% survival” sounds encouraging whereas “10% mortality” is frightening.

- (p. 371) ⭐ Sunk #costs should be ignored.

- (p. 374) When an “#impossible” event is observed, the #theory is falsified.

Part 5: Two Selves

Chapter 35: Two Selves

- (p. 378) ⭐ A decision maker who pays different amounts to achieve the same gain of experienced #utility (or be spared the same loss) is making a #mistake.

- (p. 378) The only basis for judging that a decision is wrong is inconsistency with other preferences.

- (p. 381) Two selves:

- The experiencing self is the one that answers the question: “Does it hurt now?”

- The remembering self answers: “How was it, on the whole?”

- (p. 381) ⭐ What we learn from the past is to maximize the qualities of our future memories, not necessarily of our future experience. This is the tyranny of the remembering self.

Chapter 36: Life as a Story

- (p. 387) Duration neglect is normal in a story, and the #ending often defines its character.

- (p. 387) #Caring for people often takes the form of concern for the quality of their stories, not for their feelings.

- (p. 389) ⭐ The photographer does not view the scene as a moment to be savored but as a future #memory to be designed.

- (p. 389) It is the remembering self that chooses vacations.

- (p. 389) ⭐ People choose by #memory when they decide whether or not to repeat an #experience.

- (p. 390) Most people are remarkable indifferent to the pains of their experiencing self.

Chapter 37: Experienced Well-Being

- (p. 393) The U-Index is the percentage of time that an individual spends in an unpleasant state. We aim for a lower U-Index in society.

- (p. 394) Our emotional state is largely determined by what we

attend to, and we are normally focused on our current activity and

immediate environment.

- There are exceptions, where the quality of subjective experience is dominated by recurrent thoughts rather than by the events of the moment.

- (p. 395) ⭐ #Happiness is the experience of spending time with people you love and who love you.

- (p. 397) People’s evaluations of their lives and their actual experience may be related, but they are also different.

- (p. 397) Beyond the satiation level of #income, you can buy more pleasurable #experiences, but you will lose some of your ability to enjoy the less expensive ones.

Chapter 38: Thinking About Life

- (p. 402) ⭐ One recipe for a dissatisfied adulthood is setting goals that are especially difficult to attain.

- (p. 402) ⭐ Focusing illusion: Nothing in life is as important as you think it is when you are thinking about it.

- (p. 405) Over time, with few exceptions, attention is withdrawn

from a new situation as it becomes more familiar.

- The main exceptions are chronic pain, constant exposure to loud noise, and severe depression.

Conclusions

- (p. 409) It does not make sense to evaluate an entire #life by its last moments, or to give no weight to duration in deciding which life is more desirable.

- (p. 409) The perspective of the #remembering self is not always correct.

- (p. 410) It is a good bet that many of the things we say we “will always #remember” will be forgotten ten years later.

- (p. 410) ⭐ The remembering self and the experiencing self must both be considered, because their #interests do not always coincide.

- (p. 412) ⭐ When we observe people acting in ways that seem odd, we should first examine the possibility that they have a good reason to do what they do.

- (p. 415)

- “System 1 does X” is a shortcut for “X occurs automatically”

- “System 2 is mobilized to do Y” is a shortcut for “arousal increases, pupils dilate, attention is focused, and activity Y is performed.”

- (p. 416) ⭐ The acquisition of #skills requires:

- a regular environment,

- an adequate opportunity to practice,

- rapid and unequivocal feedback about the correctness of thoughts and actions.

- (p. 416) ⭐ A marker of #skilled performance is the ability to deal with vast amounts of #information swiftly and efficiently.

- (p. 417) ⭐ #Observers are less cognitively busy and more open to information than #actors.

- (p. 418) ⭐ ⭐ An organization is a factory that manufactures judgements and decisions.

- (p. 418) An organization that seeks to improve its decision product

should routinely look for efficiency improvements at each of these

stages:

- the framing of the problem that is to be solved

- the collection of relevant info leading to a decision

- reflection and review

- (p. 418) Systematic training for the essential skill of conducting efficient meetings will improve decision making.

- (p. 418) ⭐ The identification of judgement errors is a

diagnostic task, which requires a precise vocabulary. Labels bring

together in memory everything we know about a bias, its causes, its

effects, and what can be done about it:

- “anchoring effects”

- “narrow framing”

- “excessive coherence”

- …

- (p. 418) There is a direct link from more precise gossip at the watercooler to better #decisions.

- (p. 418) Decision makers will make better choices when they trust their #critics to be sophisticated and fair, and when they expect their #decision to be judged by how it was made, not only by how it turned out.